Act Of Donation Louisiana

When it comes to legal matters of gift and transfer in Louisiana, the act of donation plays a crucial role. In this document, the donor voluntarily and freely transfers their property to another person, known as the donee. This act is not taken lightly and is bound by strict legal regulations.

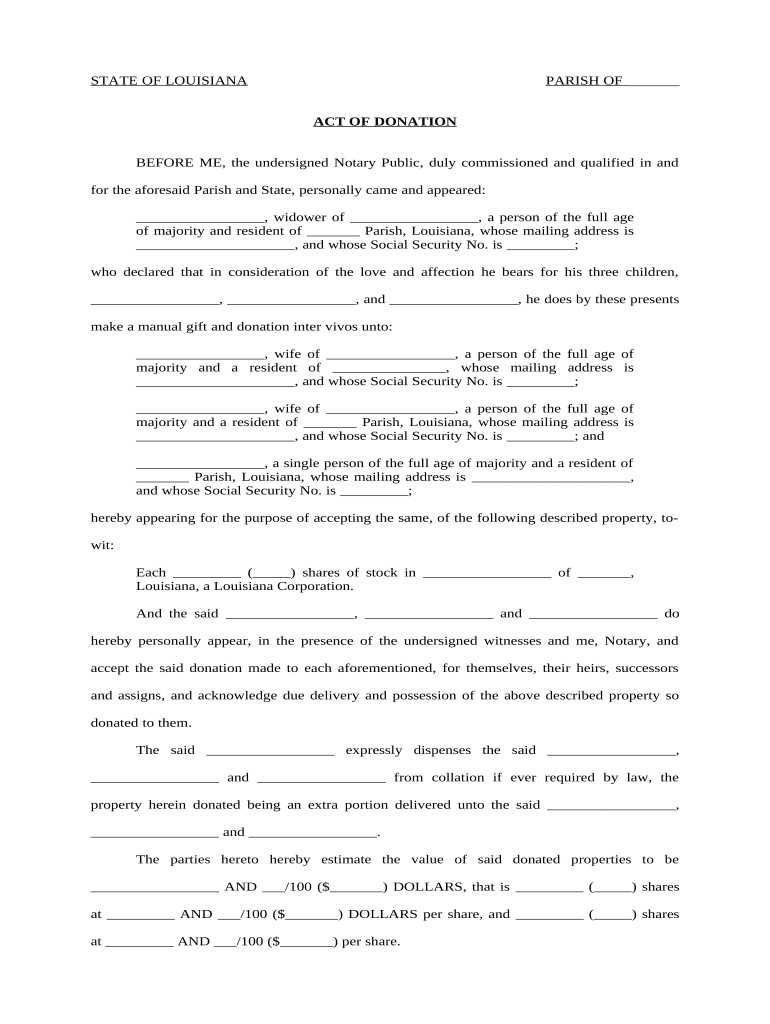

One of the key elements of the act of donation is that it must be made in writing. This written document serves as proof of the donor’s intent to gift the property and protects the rights of both parties involved. Moreover, it is essential to have the act of donation notarized by a qualified notary in order to ensure its validity.

It is important to understand that the act of donation is irrevocable, meaning once the gift has been transferred, the donor cannot take it back. This legal principle emphasizes the seriousness of this act and encourages individuals to carefully consider their decision before proceeding.

In Louisiana, the act of donation can cover a wide range of assets, including real estate, money, valuable items, and even future rights or claims. It is a powerful tool for individuals who wish to pass on their property to loved ones or support a cause close to their heart.

By understanding the act of donation in Louisiana, individuals can navigate the legal intricacies surrounding this process and ensure that their intentions are met. Whether you are considering making a donation or receiving one, it is always advisable to seek professional legal advice to make the process as smooth and legally sound as possible.

Definition and Importance of Donation in Louisiana

Donation, as defined by Louisiana law, is a legal act wherein one person, called the donor, transfers ownership of property or assets to another person, called the donee, without any consideration in return. It is a voluntary act that involves the transfer of property rights without the need for a sale or exchange.

In Louisiana, donation is considered a gift, and it is governed by the Louisiana Civil Code. The act of donation creates a legal document that outlines the transfer of ownership and establishes the rights and responsibilities of both the donor and the donee.

The importance of donation in Louisiana cannot be overstated. It allows individuals to freely transfer their property and assets to loved ones, charities, or other beneficiaries. By making a donation, the donor can provide for the needs of others and leave a lasting legacy. It is a way to express generosity, care, and compassion for others.

To ensure the validity and enforceability of a donation, it is crucial to have the document properly executed and notarized. In Louisiana, a donation must be made in writing, signed by the donor, and acknowledged by a notary public. This process adds an extra layer of authenticity and ensures that the donation is legally binding.

Overall, donation plays a significant role in Louisiana’s legal system. It allows individuals to transfer property and assets, promotes charitable giving, and enables the fulfillment of personal and philanthropic goals. Understanding the concept and importance of donation is essential for anyone seeking to engage in this act in Louisiana.

Legal Requirements and Process of Donation in Louisiana

A donation, also known as a gift, is a legal act of transferring property from one person to another without any consideration or payment. In Louisiana, the process of donation is governed by specific legal requirements to ensure its validity.

To complete a valid donation in Louisiana, the following legal requirements must be met:

1. Donation Must Be Voluntary: The act of donation must be voluntary, meaning that the donor must freely and willingly decide to transfer their property to the recipient.

2. Capacity of the Donor: The donor must have the legal capacity to make a donation. This means they must be of sound mind, at least 18 years old, and not under any legal disability.

3. Written Document: A donation must be made in writing to be legally valid. The document must clearly state the intent to donate, describe the property being transferred, and contain the signatures of both the donor and the recipient.

4. Notary Public: Louisiana law requires a donation to be witnessed and notarized by a notary public. The notary public ensures the authenticity of the document and verifies the identities of the parties involved.

5. Acceptance by the Recipient: The donation becomes valid only when the recipient accepts the gift. Acceptance can be demonstrated through written acknowledgement or by taking possession of the donated property.

By following these legal requirements and going through the proper process, individuals in Louisiana can ensure the validity of their donation and protect the rights and interests of all parties involved.

Tax Implications and Benefits of Donation in Louisiana

When it comes to making a donation in Louisiana, understanding the tax implications and benefits is crucial. By familiarizing yourself with the necessary information, you can make an informed decision and maximize the advantages of your charitable act.

1. Tax Implications

Donating assets or funds can have significant tax implications in Louisiana. The act of donation is considered a legal transfer of ownership where the donor willingly gifts their property to another individual or organization. By properly documenting the donation, you can potentially benefit from tax deductions.

Accepted donations may include real estate, cash, stocks, or any other valuable assets. These donations are subject to different tax rules and benefits, depending on various factors such as the type of asset, its value, and the recipient. It is advisable to consult with a tax professional or seek professional advice to fully understand the tax implications specific to your situation.

2. Benefits of Donation

In addition to potential tax deductions, making a donation in Louisiana comes with various benefits. By giving back to the community or supporting charitable organizations, you can contribute to causes you care about and make a positive impact.

Donating can also provide personal satisfaction and fulfillment, knowing that your generosity has made a difference. It can strengthen relationships with organizations and individuals you support, building a sense of connection and shared values.

Furthermore, certain donations may qualify for additional benefits, such as recognition or special privileges. These perks can vary depending on the organization and your level of contribution.

In conclusion, understanding the tax implications and benefits of donation in Louisiana is essential for anyone considering making a charitable act. By recognizing the legal document involved, consulting with professionals, and being aware of potential tax deductions and other advantages, you can ensure that your donation maximizes its impact and brings benefits to both the recipient and yourself.

Common Misconceptions and Challenges of Donation in Louisiana

When it comes to the act of donation in Louisiana, there are several common misconceptions and challenges that individuals may encounter. One of the main misconceptions is that donation is a simple and informal process that does not require any legal documentation. However, this is not the case.

A donation in Louisiana is a legal act that involves the transfer of property or assets from one party to another. In order for the act of donation to be valid, it must be made in writing and signed by both the donor and the recipient. This written document is known as a donation act and serves as proof of the transfer.

Another challenge that individuals may face when it comes to donation in Louisiana is the requirement of notarization. In order for a donation act to be enforceable, it must be notarized by a licensed notary public. This ensures that the act is properly executed and witnessed.

It is important to note that a donation act is not the same as a gift. While a gift is an act of giving without any expectation of compensation, a donation act involves the transfer of property or assets with the intention of benefiting the recipient in some way. Therefore, it is crucial to understand the legal implications and requirements of donation in Louisiana.

In conclusion, there are common misconceptions and challenges associated with the act of donation in Louisiana. It is important to recognize that donation is a legal process that requires a written and notarized document for it to be valid. Understanding these requirements and misconceptions can help individuals navigate the donation process effectively.

Question-Answer:

Can a person donate their entire estate in Louisiana?

Yes, a person can donate their entire estate in Louisiana. Louisiana law recognizes the freedom to donate property, and individuals have the right to dispose of their assets as they see fit, including donating their entire estate.

Do I need a lawyer to make a donation in Louisiana?

While it is not legally required to have a lawyer to make a donation in Louisiana, it is highly recommended. A lawyer can ensure that the donation is properly executed, help navigate the complexities of the law, and provide guidance on the best approach for your situation.

What are the legal requirements for a valid donation in Louisiana?

In Louisiana, a valid donation requires three essential elements: capacity, intention, and delivery. The person making the donation must have the legal capacity to make the donation, such as being of sound mind. They must also have the intention to donate the property as a gift, and there must be an actual delivery of the property to the recipient.

Can I donate property that is subject to a mortgage in Louisiana?

Yes, you can donate property that is subject to a mortgage in Louisiana. However, it is important to note that the recipient of the donation will generally assume the responsibility for the mortgage. It is important to communicate with the recipient and consult with a lawyer to ensure all legal requirements are met.

What are the tax implications of making a donation in Louisiana?

When making a donation in Louisiana, there may be potential tax implications. Depending on the value and nature of the donated property, you may be eligible for certain tax deductions or exemptions. It is advisable to consult with a tax professional or lawyer to understand the specific tax implications of your donation.

What is donation in Louisiana?

In Louisiana, donation refers to the act of one person giving property or assets to another person, either during their lifetime or through a will.

How does donation work in Louisiana?

In Louisiana, donation can be made through a notarial act, which requires a notary public to draft and execute a written document. The document must contain the donor’s intent to transfer ownership, a description of the property being donated, and the acceptance by the recipient. Alternatively, donation can also be made through a testamentary act, by including specific provisions in a will.