Calculate Your Tax Deduction for Charitable Donations

Are you looking for a simple and efficient way to calculate your tax deduction for charitable donations? Look no further! Our intuitive calculator is here to help you calculate the exact amount you can deduct from your taxes.

Donating to charitable organizations is a wonderful way to make a positive impact on society. Not only does it help those in need, but it can also provide you with a tax benefit. By making a donation, you may qualify for a deduction on your tax return.

Our user-friendly calculator takes into account the different types of donations you’ve made throughout the year, such as cash, stock, or property. Simply input the values and let our calculator do the rest. It will provide you with an accurate estimate of your tax deduction.

Why spend hours trying to figure out your deduction manually when you can have instant results with our convenient calculator? Don’t miss out on potential savings – start using our calculator today!

Overview of Tax Deductions

When it comes to taxes, understanding tax deductions can help you save money. Tax deductions are expenses that can be subtracted from your taxable income, reducing the amount of tax you owe. Charitable donations are one such deduction.

By using our calculator, you can easily calculate your tax deduction for charitable donations. Whether you donate to charitable organizations, nonprofits, or other eligible entities, our calculator can help you determine the deductible amount.

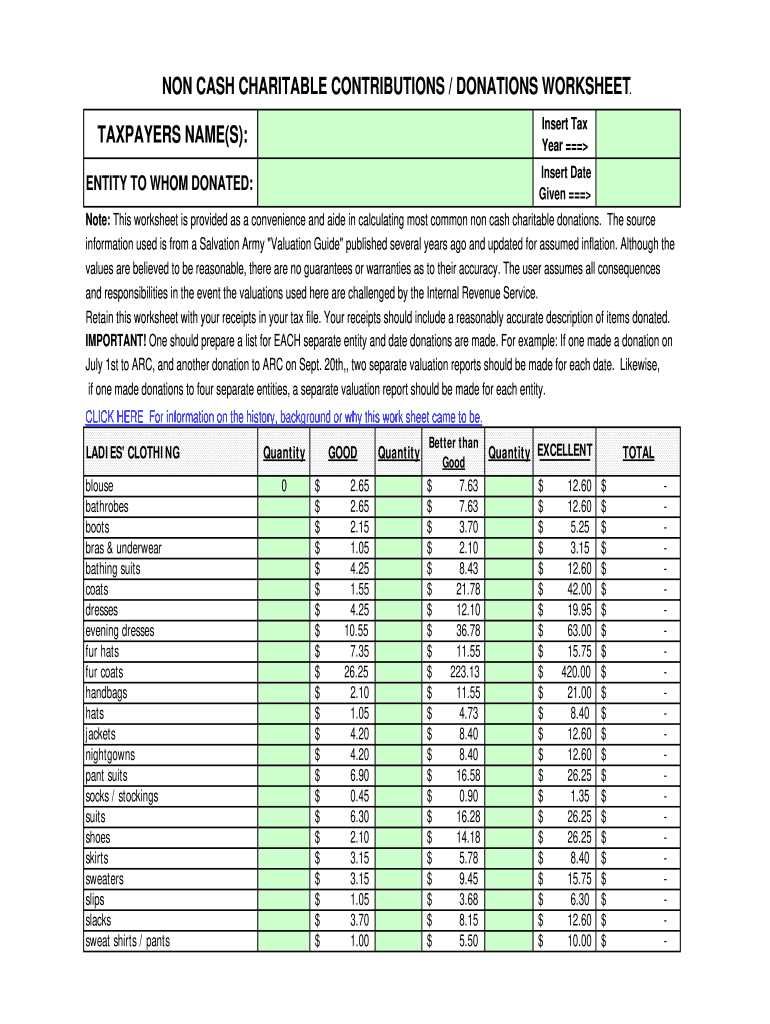

When making charitable donations, it’s important to keep track of all your receipts and documentation. This includes any cash donations, as well as non-cash donations such as clothing, household items, or vehicles. The total amount of your eligible donations will determine your tax deduction.

It’s worth noting that tax deductions for charitable donations have certain limitations. The deduction is typically limited to a percentage of your adjusted gross income (AGI). The specific percentage varies depending on the type of donation and the organization receiving it.

Note: Our calculator provides an estimate and should not be considered as professional tax advice. Make sure to consult with a qualified tax professional to determine your specific tax situation.

Disclaimer: This information is provided for informational purposes only and should not be construed as legal, financial, or tax advice. It is always recommended to consult with a qualified professional before making any financial decisions.

Benefits of Using a Calculator

- Accuracy: By using a calculator to calculate your tax deduction for charitable donations, you can ensure that your calculations are accurate. This helps to avoid any errors or miscalculations that could lead to inaccurate deductions on your tax return.

- Efficiency: Calculating your tax deduction manually can be time-consuming and laborious. By using a calculator, you can save time and effort, allowing you to quickly and efficiently determine the value of your deduction.

- Consistency: Using a calculator ensures consistency in your calculations. It eliminates the risk of human error that can occur when trying to perform complex calculations manually.

- Convenience: A calculator provides a convenient tool for calculating your tax deduction. It allows you to quickly and easily input the necessary information and obtain the accurate deduction amount for your charitable donations.

- Confidence: By using a calculator, you can have confidence in the accuracy of your tax deduction calculation. This can provide peace of mind, knowing that you are claiming the correct deduction amount and maximizing your tax savings.

- Compliance: Using a calculator helps to ensure compliance with tax laws and regulations. By accurately calculating your tax deduction, you can be confident that you are meeting the requirements set forth by the tax authorities.

Take advantage of the benefits that come with using a calculator to calculate your tax deduction for charitable donations. Enjoy accuracy, efficiency, convenience, and compliance, all while maximizing your tax savings.

How to Use Our Calculator

Using our tax deduction calculator for charitable donations is a simple and straightforward process. Just follow the steps below:

Step 1: Enter Your Donation Amount

Start by entering the total amount of your charitable donation in the designated field. This is the amount that you contributed to a qualified charitable organization during the tax year.

Step 2: Select Your Tax Rate

Next, choose your current income tax rate from the options provided. This is important as it will affect the value of your tax deduction.

Step 3: Calculate Your Tax Deduction

Click on the "Calculate" button to determine the tax deduction for your charitable donations. Our calculator will instantly provide you with the amount you can deduct from your taxable income.

Step 4: Understand Your Tax Savings

Once you have the calculated tax deduction amount, you can understand how much you can save on your taxes by making charitable donations. This savings can help reduce your overall tax liability.

Using our calculator ensures that you get an accurate estimation of your tax deduction for charitable donations. It saves you time and effort when calculating your tax deductions manually.

| Note: | The tax deduction amount provided by our calculator is an estimation and should be verified with a tax professional. |

Start calculating your tax deduction for charitable donations today and maximize your tax savings!

Question-Answer:

How does the tax deduction calculator work?

Our tax deduction calculator takes into account your total charitable donations made during the tax year and uses the current tax laws to calculate the tax deduction you may be eligible for. Simply input your donation amount and other relevant details, and the calculator will provide you with an estimate of your tax deduction.

What information do I need to use the tax deduction calculator?

You will need to know the total amount of your charitable donations made during the tax year, the type of donations made (cash, property, etc.), and any other relevant information requested by the calculator. The more accurate information you provide, the more accurate the tax deduction estimate will be.

Can I use the tax deduction calculator to calculate deductions for donations made to international charities?

The tax deduction calculator is designed to calculate deductions for charitable donations made to eligible organizations within your country’s tax jurisdiction. If you have made donations to international charities, you may need to consult with a tax professional or refer to your country’s tax laws for guidance on how to calculate deductions for those donations.

Is the tax deduction calculator free to use?

Yes, our tax deduction calculator is completely free to use. We believe that everyone should have access to tools that help them make informed financial decisions. We do not require any personal information or ask for payment to use the calculator.